Betting Site With No Tax

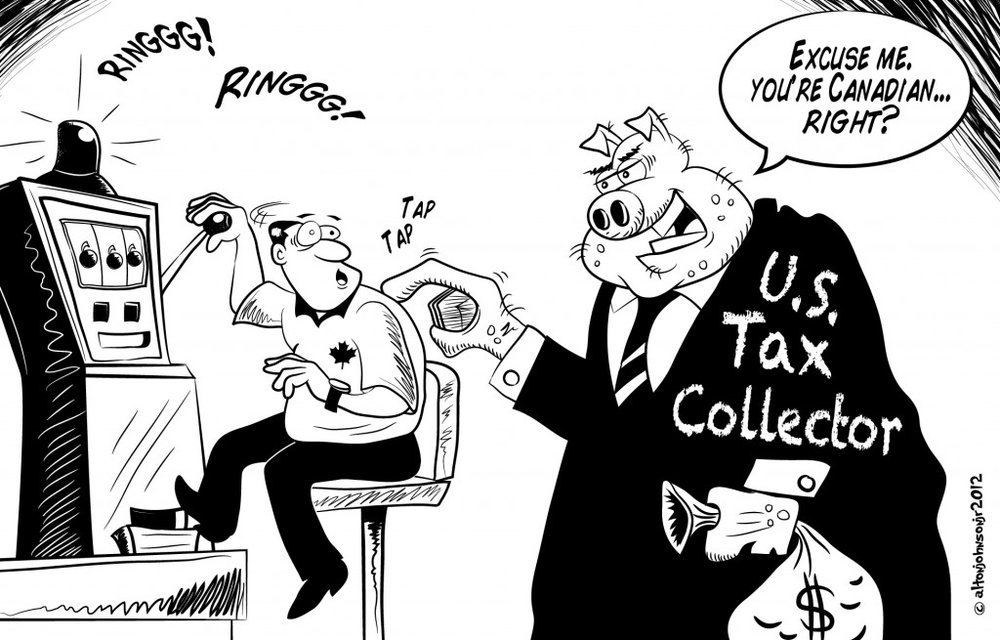

No, gambling is tax free in the UK. While players in some countries such as the USA, France, and Macau have to deal with gambling taxes between 1% and 25%, bettors in the United Kingdom. The government concerns with these betting sites in Kenya included tax concerns. Last year the betting industry made around Sh204 billion but only remitted Sh4 billion in taxes. Moreover, most of the companies did not submit the 20% withholding tax on payouts.

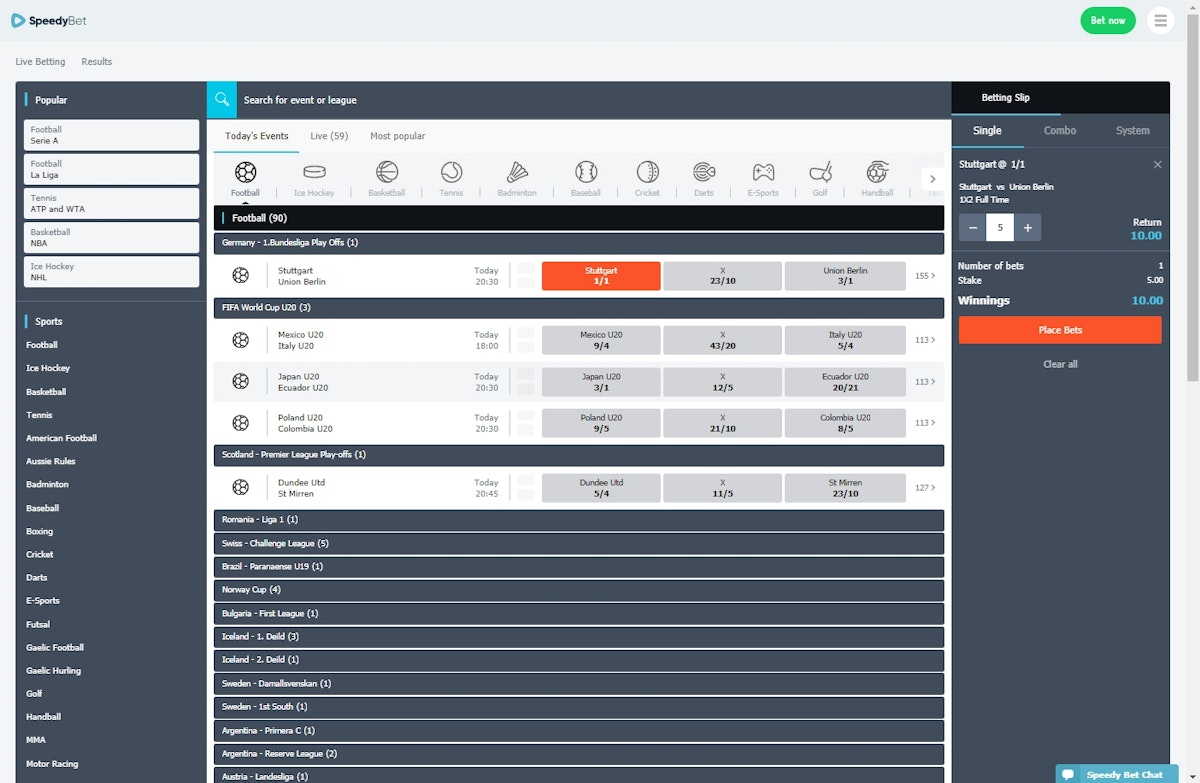

But in short, that -110 is telling you that you must pay a 10% cut on your bet no matter what side you want to bet. Let’s use that example from DraftKings above. Penn State is a 6.5-point. No betting site is 100% perfect, but the best betting sites in Kenya are very good at all of the above listed features. 🏀 What sports are available on betting sites in Kenya? ⚽ You can bet on a wide variety of sports in Kenya. The Italian government looked to increase tax revenue and capitalize on the country’s love of soccer by introducing legislation to allow sports betting in the mid-2000s. This allowed anyone who acquired a license to take sports betting action either online or in a land-based retail environment.

Betting Sites Usa

Scope of the Charge

Betting Duty is charged on:

- the net stake receipts derived from the conduct of authorized betting on horse races by an authorized company;

- contributions or subscriptions to authorized cash-sweeps;

- the proceeds on lotteries conducted by an authorized company; and

- the net stake receipts derived from the conduct of authorized betting on football matches by an authorized company.

Rate of Betting Duty

Betting Site With No Tax

The duty rates for various bets are as follows:

| Betting on Horse Races | Cash-Sweeps | Lotteries (Mark Six) | Betting on Football Matches | |||

|---|---|---|---|---|---|---|

| Duty Rate | Local bets on local horse races | Rate of duty % | 30% on the amount paid, contributed or subscribed | 25% on the amount of proceeds | 50% on the net stake receipts | |

| (a) | On the first $11,000,000,000 of the net stake receipts | 72.5 | ||||

| (b) | On the next $1,000,000,000 of the net stake receipts | 73 | ||||

| (c) | On the next $1,000,000,000 of the net stake receipts | 73.5 | ||||

| (d) | On the next $1,000,000,000 of the net stake receipts | 74 | ||||

| (e) | On the next $1,000,000,000 of the net stake receipts | 74.5 | ||||

| (f) | On the remainder | 75 | ||||

| Local bets on non-local horse races | Rate of duty % | |||||

| (a) | Net Stake receipts | 72.5* | ||||

| *The rate of duty applicable to the bets on Non-local Horse Races comes into operation on 1 September 2013. | ||||||